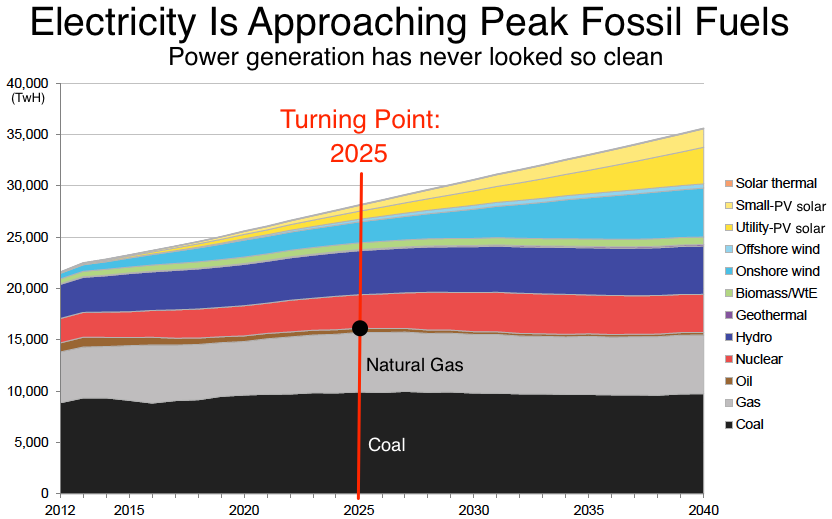

Energy outlook 2019

Renewable energy sources are set to represent almost three quarters of the $10.2 trillion the world will invest in new power generating technology until 2040, thanks to rapidly falling costs for solar and wind power, and a growing role for batteries, including electric vehicle batteries, in balancing supply and demand. […]

Quality matters

At RODACHEM we take QUALITY seriously!

We are proud to inform you that as of 2016, we have been officially certified ISO 9001:2015

Our quality management history dates back now more than 25 years, since we first achieved the first ISO certificates. In the meantime we have grown and have successfully implemented RESPONSIBLE CAREprocedures for which we were audited lately and extended validity for 3 years.

A sign of our continuous commitment to delivery quality service and responsible solutions to our customers worldwide.

Lithium news

LITHIUM is going through vigorous turbulent times, in a market that is transitioning to mass demand for renewable energy sources and the need for mass energy storage. This highly strategic material is the key to future energy management and the best performing raw material for every day use batteries up to high energy storage devices for the military and aerospace. But LITHIUM is also used for a wide array of normal applications, from glass and ceramic, to aluminium and alloy production. […]

Energy outlook 2016

By 2040, zero-emission energy sources will make up 60% of installed capacity. Wind and solar will account for 64% of the 8.6TW of new power generating capacity added worldwide over the next 25 years, and for almost 60% of the $11.4 trillion invested. […]

New products

We are proud to announce the introduction of a new product: LITHIUM BROMIDE

RodaChem can now offer from relibale sources a LITHIUM BROMIDE based solution for application in the chillers and air conditioning industry. our solutions are adjutsted to meet the concentration requirements of customers and can be inhibited with various additives, for example LITHIUM MOLYBDATE and LITHIUM CHROMATE. […]